One Size Fits All?

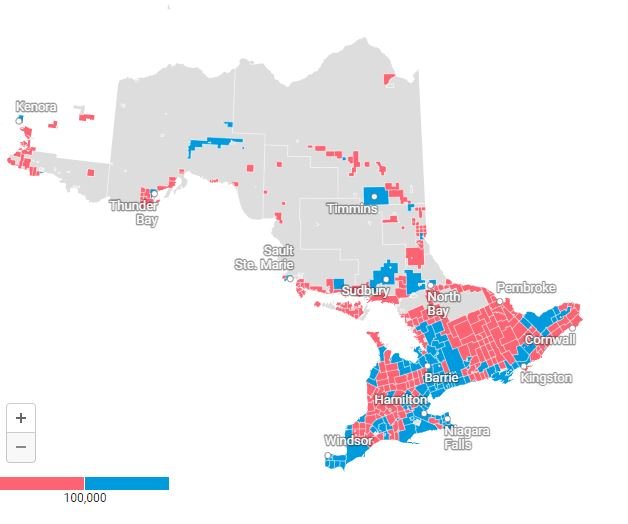

External shocks and legislative design decisions combust in municipal budget deliberations, giving Councils more credit for undesirable situations than they have control over them because the conflicts preceding budget approval are newsworthy and the final decision about how to respond happens in Council chambers.

Though broadly discrediting to municipal institutions and actors, the sequence unfolds in ways that are more damaging to economically disadvantaged areas and more damning for their municipal leadership.

There’s Only One Ratepayer

When developers don’t cover the cost of the infrastructure required for new development, municipal Councils have two choices for where to make up the difference: Spend less on services, thereby reducing service levels across the board, or spend the same on services by charging more through other revenue streams: Taxes and fees.

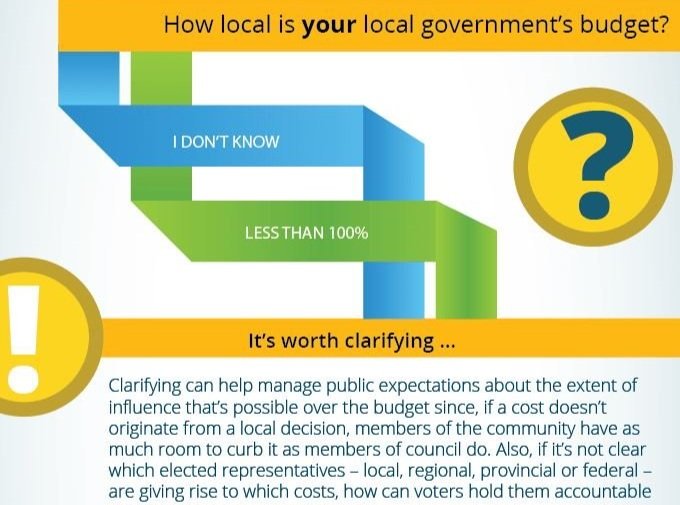

Come Clean: Taking a Look at How Far the Provincial Hand is in the Municipal Pocket

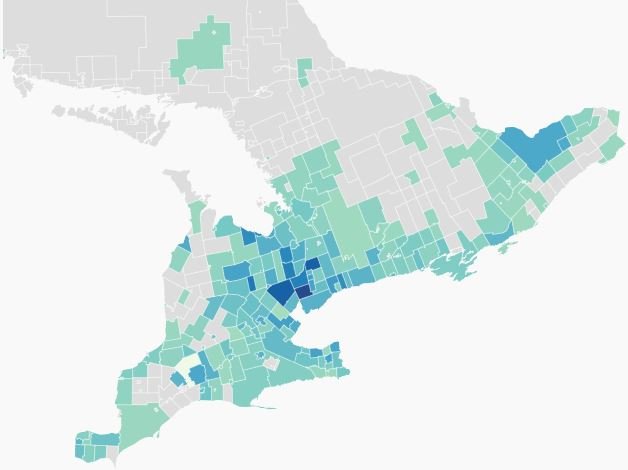

We often hear that local governments in Canada get just 9 cents of every tax dollar. But how much of that is even a council’s to spend?

One study found that just 9% of a municipality’s annual operating spend flowed from council decisions.*

How local is your local government’s budget?

Workshop: Goodbye Gap, Hello Black (BETA)

How municipal staff can leverage alternative revenue methods to do more than balance the budget.

Four Budget Visuals to Help You Tell Your Story

Infrastructure ownership changes and challenges.

Discrepancies between Council’s verbal and financial commitments to capital projects.

Rate-setting and levy presentation refinement.

How to demonstrate the value of municipal services so that residents get an hourly reminder from their own body.